FUTURE TRENDS ::

Media and entertainment revenues in the United States grew at more than twice the rate of inflation (9.8 percent per year) between 1992 and 1998, to $488 billion. The combined revenues of these exploding economic sectors, which run the gamut from TV to phone service, print to the Internet, movies to spectator sports, are expected to grow an average of 8.3 percent per year to top the $1 trillion mark in 10 years.

By 2008, the major change in film revenues is expected to come from emerging technologies that have existed for several years but have not yet been a major factor - pay-per-view, direct broadcast satellite, and video-on-demand. By the end of the last decade, the theatrical box office dipped to 25% of worldwide revenues and is expected to take a slight dip again to 24.4%. Home video, which had been decreasing in importance throughout the 1990’s, will see a significant decrease from 41% of total revenues to 35.7%.

New technologies are volatile in their movements and can change at any time. DVD, for example, which came into the American market later than expected due to problems with determining standards, is now supported by all the major studios. What impact will the new technologies have on theater attendance? Many different projections appear in the news media. A 500 channel television universe seems less certain than it did 10 years ago. Most experts believe that theatrical exhibition will always be the vehicle that drives the popularity of products played in the home and other outlets. However, new digital technology for exhibition has recently been developed that will dynamically lower the cost of filmmaking in the next 5 to 10 years. New technologies aside, theatrical exhibition is not likely to disappear during our lifetime and continues to flourish.

THE MARKET ::

An independent film goes through the same process from development and pre-production through production and post-production as a studio film. In this case, however, development and pre-production may involve only one or two people, and the entrepreneur, whether producer or director, maintains control over the final product.

An independent company is one that finds its production financing outside of the studios. It may be distributed by a studio, but negative cost has been found from other sources. Many of the large production companies started with the success of a single film. Carolco was built on the success of “Rambo III” and “Terminator II”; New Line Cinema achieved prominence and clout with the “Nightmare on Elm Street” series.

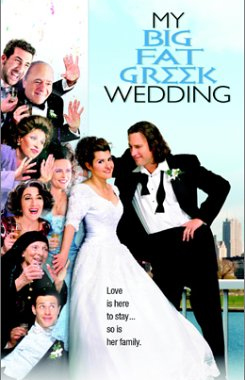

The smaller production company usually raises money for one film at a time, although there may be other films in different phases of development. Many companies are owned or controlled by the creative person, such as a writer/director or writer/producer, in combination with a financial partner or group. As small companies go out of business, new ones form to take their place. Since the beginning of the 1990’s, independent film has been going through one of its “up” cycles. Traditionally, the fortunes of independent filmmakers have always cycled up and down from year to year. The recent success of independent films, such as “The Blair Witch Project” and “My Big Fat Greek Wedding”, has sent the independent segment into another growth spurt.

The market for specialty films has also been growing. All across the United States are individual, independently-owned theaters that maintain their own direct mail lists of faithful movie-goers. Often, a film made for $500 thousand or less can earn back its costs from these regulars alone. Until recently, the independently-owned theaters were thought of as the home of the offbeat and unique film.

Like “My big fat Greek Wedding”, we feel that “Stone Soup” will find a home in both the art houses and the multiplexes. Because of the low budget, however, the film will most likely play in the specialty theaters at first. Exhibitors may wait for the film to prove itself before providing access to the larger venues. The smaller houses will give us the chance to expand the film slowly and build public awareness. As word of mouth spreads, both the distributor and the owners of the big theater chains will want to have our films play in the multiplexes.

DISTRIBUTION ::

Most of the marketing strategies commonly employed by independent distributors will be used to market “Stone Soup”. The actual marketing of the film itself is the distributor’s job, and involves the representation of the film in terms of genre, the placement of advertisements in various media, the selection of a sales approach for exhibitors and foreign buyers, and the “hype” (word of mouth, promotional events, alliances with special interest groups, and so on). All of these factors are critical to a film’s success.

Each major studio has its own distribution division. All marketing and other distribution decisions are made in-house. This division sends out promotional and advertising materials, arranges screenings of films, and makes deals with domestic and foreign distributors. The studios each release 15 to 25 films a year, and they occasionally acquire independent films to release. For our projects, however, we will seek distribution by an independent company such as Lion’s Gate, Dimension Films, or Screen Gems.

We feel that independent distributors often have the knowledge and patience to give special care to eclectic or mixed-genre films. Many independents will allow a film to find its audience slowly and methodically. However, this does not mean that independent distributors will not want to release films with mass appeal. For such films with smaller budgets and lesser names, they often have an expertise that the studios lack. In addition, by focusing their marketing and promotional efforts on a handful of primary markets, these companies are able to keep their costs relatively low. Because their focus is on fewer films, we feel that our film will receive better care than at a large studio.

The first step in distributing a film is having copies made of it for motion picture presentation. The prints sent to the theaters are duplications of the “master” print, which is made from the original edited negative. A print usually costs $1200 to $1500, depending on the length of the film and current film stock costs. Major studio films typically are opened wide, that is on thousands of screens simultaneously. The cost of prints for this type of release is more than $1 million, which is impossible for low-budget films. Although the independent distributor begins with fewer prints, several hundred may be made throughout the film’s release period. While a film is in release, therefore, the total print cost can be appreciable.

The domestic territory is defined as both the United States and Canada combined. Many of the independent distributors consider the United States and Canada to be one package and prefer not to have them separated beforehand. Domestic rights refer not only to theatrical distribution but to all media, such as video, cable, pay-per-view, and television. When a producer secures an advance from one of these media for production financing, he or she makes the deal a little less attractive to potential distributors by fractionalizing the rights. Any source of future revenue that is taken out of the potential money pie makes it more difficult for the producer to close the distribution deal.

In terms of foreign sales, there are US-based distributors who specialize in the rest of the world. These companies deal with networks of sub-distributors in various countries. It is important to distinguish between a distributor and a foreign sales agent. If a distribution company is granted the rights to the film for the foreign markets, that company is the distributor. Generally, if the ownership of the foreign rights is retained by the producer, who grants someone only a percentage of the receipts in exchange for obtaining distribution contracts in each territory or for various media throughout the world, that person is actually a sales agent.

There is no typical distribution deal. The distribution company will take as much as it can get. It is SML’s job to give away as little as possible. Based on industry averages, we have used a distributor fee of 34% of the total revenue in our projections. These percentages apply only to the revenues generated by the distributor’s deals; if that company is only making foreign sales, then it takes only a percentage of foreign revenues. How much the distribution company wants depends on its participation in the entire film package. The greater the upfront expense that the company must assume, the greater the percentage of incoming revenues it will seek.

Release Strategies ::

The ways in which a film is distributed domestically (in the United States and Canada) vary with the size of the distribution company and the type of film. Audience segmentation is determined by critical appraisal and the likely interest that the film will generate. For example, the distributor might release a film carefully, market by market, and use revenues from the first group of theaters to finance the prints and advertising for the second group, and so on.

Independent distributors use several standard patterns of release strategies. The usual method is to release a film in a few theaters at a time and slowly take it to a wider release. A popular film may well end up in large multiplexes, but usually only after the film has been out for a while. This method has two advantages. It allows unique films to receive special handling, and it allows a popular-genre, low-budget film to move as fast as its advertising budget permits.