THE INDUSTRY ::

Along with many corporations in the United States, the major studios began the radical process of restructuring or “downsizing” at the end of the 1990’s. While in the past they all maintained expensive production facilities and staff and significant overhead expenses, the impact of unions and guilds and runaway production budgets have forced studios to follow new business models.

The success of 1999’s “The Blair Witch Project”, which has grossed more than $200 million in worldwide revenues to-date, has signaled a new day for independent films. It has revolutionized how studios and distributors look at the production and marketing of films. Independent films can vary widely in budget, from just a few thousand dollars to as high as $100 million, but their similarity is a freedom from the homogeneity of studio production. By definition, an independent film is one that is financed by any source other than a U.S. studio. With their ability to take more time and their need to plan budgets more carefully than studios tend to do with their big-budget films, smaller companies are able to give greater attention to their lower-budgeted stories. Unlike studios, the independent production companies are able to avoid substantial overhead by hiring creative and other production personnel on a project-by-project basis. And due to their low budgets, these films can be directed at niche markets rather than having to appeal to the entire film-going audience. They typically finance their production activities from discrete sources, and their goal is to completely finance their motion pictures before the commencement of principal photography.

The structure of the motion picture industry has been changing over the past few years, with independent films steadily gaining market share since the early 1990’s. In 1998, the U.S. box office for American independent films is estimated at $2.0 billion, with another $2.3 billion coming from international box offices. Today the worldwide market for these films is estimated to be more than $8 billion. While U.S. theatrical distribution is still the first choice of any feature-length film, international markets are continuing to gain strength. U.S. feature film distributors’ total worldwide revenue in 2004 was more than $19 billion, up from approximately $13 billion in 2000.

At a studio, a film begins in one of two ways. Someone inside the company might develop a “concept” (one or two lines of an idea), or a known writer might make a pitch (a quick presentation of an idea) and secure a deal. On the other hand, an agent might bring a script by a new writer to the attention of the studio. Scriptwriters are hired, lead actors sought, budgets approved, and directors and producers assigned. This process is called development.

The next step is preproduction, the period before principal photography when commitments are sought for talent, budgets are finalized, the director and crew are hired, and contracts are finalized and signed.

The filming of a motion picture is called principal photography and it generally takes from 8 to 12 weeks, although major cast members may not be used for the entire period. Once the production has gotten to this stage, it is unlikely that a studio will shut it down. Even if the picture goes over budget, the studio will usually find a way to complete it.

During the post-production period that follows principal photography, the film is edited and synchronized with music and dialogue. In certain cases, special effects are added. The post-production process used to require six to nine months. With recent technological developments, this time has been cut dramatically for some films.

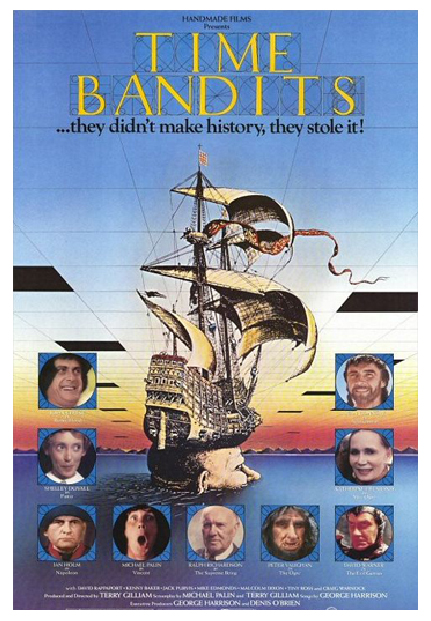

“Stone Soup” will have characters as

colorful as ”Time Bandits”.

Theatrical Exhibition ::

The exhibitor (theater) pays a percentage of the picture’s box office receipts (called rentals) to the studio or distributor. The size of the percentage depends on the distributor’s strength and the exhibitor’s desire to show the film. A major studio release usually has a 50/50 split, while independent film averages 49 percent (up from 47 percent in 1997 and 45 percent in 1994) from the box office. Of course, the exhibitor keeps all the money for popcorn, candy, and soft drinks.

The U.S. release of a film usually ends within the first year. Major studio films may go out to as many as 3,000 screens in the first few weeks. Independent films will start more slowly and build on their success. Although the amount of rentals will decline toward the end of the film’s run, they may well increase in the first few months. It is not unusual for a smaller film to gain theaters as it becomes more popular.

Because revenues from all other sources are driven by the success of the theatrical distribution, a film’s stay on theater screens is important. Coupled with this is the exhibitor’s basic desire to see people sitting in theater seats. Although the studio has some power to keep a mediocre film on the screen with its greater resources for marketing and promotion, good independent films will get shown. Exhibitors have always maintained that they will show any film they think their customers will pay to see. Depending on the location of the individual theater or the chain, local pressures may play a part in deciding which films will be shown. Not all pictures are appropriate for all theaters. Despite the new technologies on the horizon, theatrical exhibition is not likely to disappear during our lifetime.

OTHER SOURCES OF REVENUE ::

Cable and Broadcast Television ::

Television exhibition includes over-the-air reception for viewers either through a free system (cable) or free television (national and independent broadcast stations). The proliferation of new cable networks in the last twenty years has made cable (both basic and premium stations) one of the most important outlets for feature films and documentaries. Whereas network and independent television stations were a substantial part of the revenue picture in the 1970’s and early 1980’s, cable has become a far more important ancillary outlet. The PPV (pay-per-view) business had a banner year in 1998, according to analyst Paul Kagan, up nearly 35% to $741 million, thanks to continued DBS (direct broadcast satellite) growth and significant NVOD (near video on demand) rollouts by cable operators. Pay-per-view and pay television allow cable television subscribers to purchase individual films or special events, or to subscribe to premium cable channels for a fee. Both media acquire their film programming by purchasing the distribution rights from motion picture distributors.

Home Video ::

A large source of motion picture revenues continues to be the worldwide home video market. Home video companies promote and sell videocassettes and videodiscs to local, regional, and national video retailers, which then rent the cassettes and discs to consumers for private viewing. They also sell directly to consumers in what is termed the “sell-through” market. London-based Baskerville Communications estimates worldwide spending on DVD software in 2000 of $9.1 billion, including $4.7 billion in the U.S., compared to $38.1 billion for VHS. By 2010, however, the ratio will be reversed, with worldwide spending on DVD of $64.7 billion versus $2.5 billion on VHS. By the end of the decade, Baskerville says, DVD players will be in 625 million households worldwide, including 94 million the US.

International Theatrical and Ancillaries ::

Much of the projected growth in the worldwide film business comes from the international markets. Distributors and exhibitors keep finding new ways to increase the box office revenue pool. The growth of multiplexes in Europe is being followed by more screens in Asia and Latin America. Other factors are the privatization of television stations overseas, the introduction of direct broadcast satellite services, and increased cable penetration. In 1998, an estimated 58 percent of all worldwide revenues for American films came from the United States. The same data for 2003 is projected to change slightly, with 56 percent from the U.S. and 44 percent from foreign venues of all types.